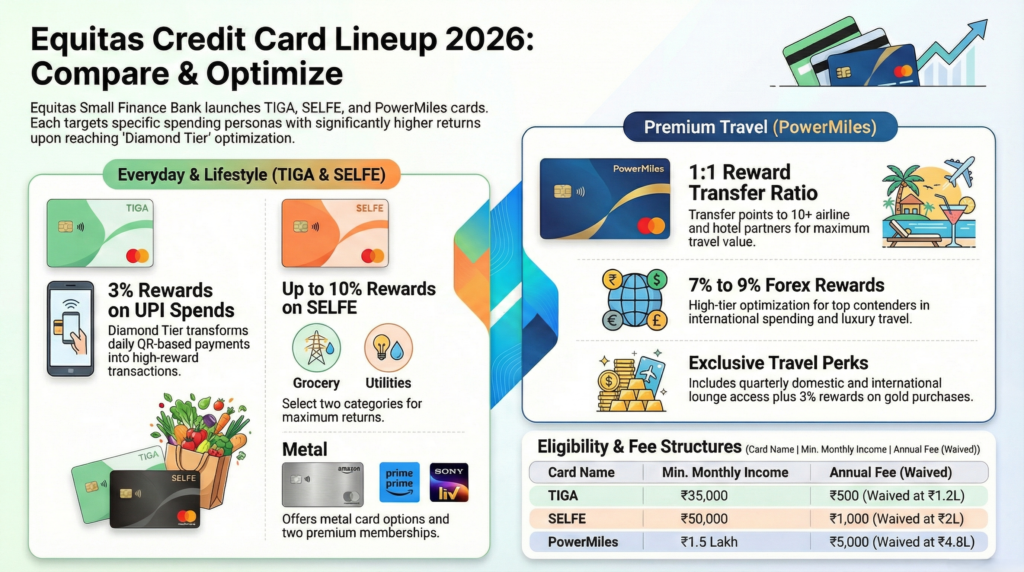

In a move that has taken the credit card community by surprise, Equitas Small Finance Bank has officially launched three new credit cards: TIGA, SELFE, and PowerMiles. While many expected basic offerings from a Small Finance Bank, Equitas has dropped three “serious” contenders that are decent, practical, and cater to very specific user needs

• Equitas Tiga Credit Card

• Equitas Selfe Credit Card

• Equitas PowerMiles Credit Card

None of these cards are flashy lifestyle cards, but they serve real use cases.

👉 Apply Now: Click here to Apply for Equitas Credit Cards

Which Equitas Card Should You Choose

If you are able to consistently hit Diamond Tier, the Equitas credit cards become far more rewarding than they appear at first glance. Here is how each card performs when optimised correctly.

Tiga Credit Card – Best for UPI Heavy Spends

Tiga shines for users who make frequent UPI payments.

• Lifetime Free when applied through the SmartSpendCode link

• Up to 3% rewards on UPI transactions under Diamond Tier

• Ideal for daily QR based payments like groceries, local stores, and small merchants

If most of your monthly spends happen via UPI, Tiga is one of the very few cards that rewards UPI meaningfully.

Selfe Credit Card – High Rewards on Planned Monthly Categories

Selfe works best when your spends are structured and predictable.

• First year free when applied through the SmartSpendCode link

• Choose either Grocery up to ₹20,000 per month plus Apparel

• Or Utilities up to ₹20,000 per month plus Apparel

• Earn up to 10% rewards under Diamond Tier

This card is ideal for users who plan their monthly expenses in advance and want maximum returns in select categories.

PowerMiles Credit Card – Built for International Travellers

PowerMiles is a niche card, but extremely powerful when used correctly.

• 7% to 9% effective rewards on forex spends under Diamond Tier

• 3% rewards on gold purchases

• Faster approvals generally seen for users with CIBIL score above 750

For frequent international travellers, PowerMiles can deliver value that rivals many premium cards.

Income Eligibility and Approval Notes

Currently, Equitas is processing salaried applicants only.

Minimum net monthly income requirements:

• Tiga Credit Card: ₹35,000

• Selfe Credit Card: ₹50,000

• PowerMiles Credit Card: ₹1.5 lakh

If you face any issues during application or approval, feel free to email or DM me. I will help check the reason with the bank and guide you on the next steps.

SmartSpendCode Overall Verdict

Equitas has delivered a surprisingly mature first lineup. These cards are not meant to compete with super-premium offerings, but they fill important gaps in the market.

• Tiga works well for cashback seekers

• Selfe supports credit inclusion

• PowerMiles serves practical travellers

For users who understand their spend patterns, one of these cards can fit nicely into a broader card portfolio.

How to Apply – Step by Step

Step 1 Apply here 🔗 https://link.smartspendcode.com/EquitasCreditCard Get your pre approved credit limit instantly

Step 2 Click on the same link again to initiate VKYC

Step 3 Complete VKYC and wait for at least 1 day

Once approved, customer ID is issued and the physical card is delivered in 4 to 5 days.

Apply Now

If you are interested in any of the Equitas credit cards, you can apply using the link below:

👉 https://link.smartspendcode.com/EquitasCreditCard

Note: Card features and benefits are subject to change by the issuer. Always verify the latest terms before applying.

![OFFER ALERT: Earn up to 16.5% on Your Forex Spends! [OFFER EXPIRED]](https://smartspendcode.com/wp-content/uploads/2025/03/5xoffer-120x86.webp)